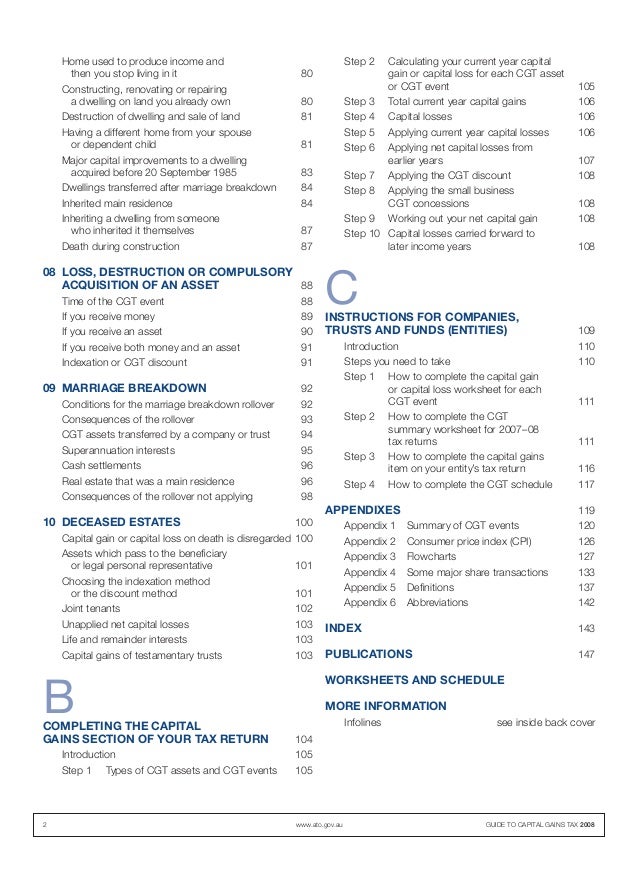

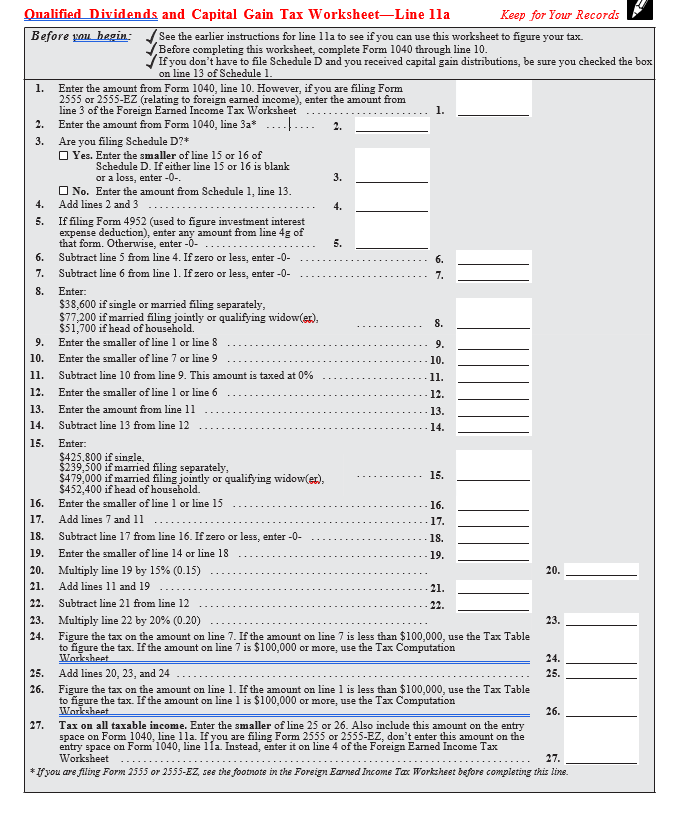

Capital Gains Tax Worksheet Ato. There is a Capital gain or capital loss worksheet provided at the back of this guide that you may wish to use to. When you use the ATO's capital gain or capital loss worksheet there are three main categories which can be added to the cost base of your property Capital Gains Tax (CGT) is a term you'll often hear as tax time draws near.

Basically, if you buy shares, property, or other assets for one price and sell them for another price, the difference between.

The capital gain you make on an investment property is calculated under special rules, with the There is no separate 'tax'.

This guide is not available in print or as a downloadable PDF (Portable Document Format). When you sell capital assets, like real estate, cryptocurrency or shares, you can either You're only obliged to pay CGT when you receive capital gains from the sale of assets that you acquired after To make computing capital gains tax easier, use the ATO's CGT calculator.. This worksheet helps you calculate a capital gain or capital loss for each capital gains tax (CGT) asset or any other CGT event.