Tax Write Off Worksheet. Financial institutions use write-off accounts when they have exhausted all methods of collection action. The Schedule D tax worksheet helps investors figure out the taxes for special types of investment sales, including real estate buildings that have depreciated and collectible items, such as art or coins.

If you work from home, there are a surprising number of things that may be tax-deductible for you, including your home office and even your WiFi bill.

First, costs related to tax-exempt securities; they are nondeductible because they generate tax-free income.

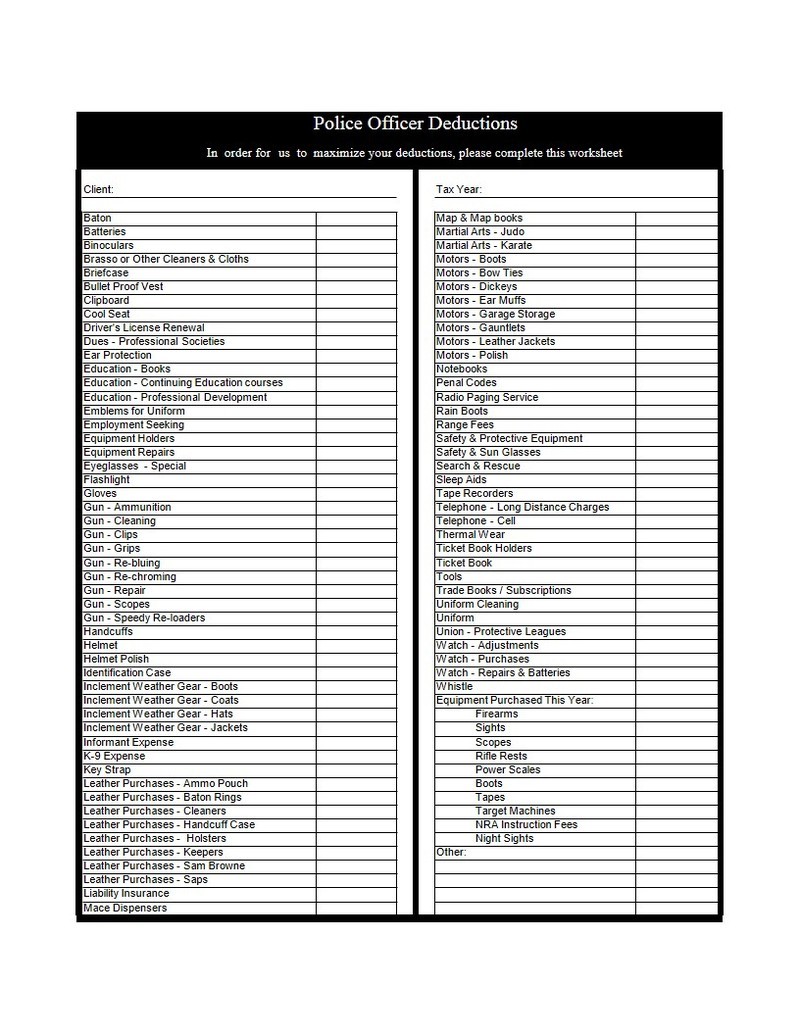

What Can I Write Off As A Deduction? If you want to deduct business expenses from your income you need to keep a record of your. Did you scroll all this way to get facts about tax write off?